The Dark Side of Prompting: Understanding and Mitigating AI Security Risks (Jailbreaks, Data Leaks)

December 4, 2025

The Rise of AI Whisperers: Case Studies from the World’s Top Prompt Engineers

December 11, 2025✍️ Introduction: When AI Meets Your Wallet

Managing money has always been one of those things everyone knows they should do better—but few people actually enjoy. Between complex budgeting tools, market volatility, and confusing investment jargon, it’s easy to feel overwhelmed. But what if artificial intelligence could make managing your personal finances as easy as chatting with a friend?

That’s where AI Personal Finance comes in. By using tools like ChatGPT or Gemini with well-crafted prompts, you can create personalized budgets, investment strategies, and even retirement plans—no financial degree required.

📊 Why AI Prompts Are the New Personal Finance Advisors

AI-powered financial planning is no longer just a Silicon Valley experiment. It’s a fast-growing trend among smart individuals who want to take control of their money using AI prompts for personal finance.

Here’s what makes it powerful:

- Personalized insights: AI can adapt to your unique income, spending habits, and goals.

- Time-saving automation: Generate instant summaries, forecasts, and spending analyses.

- Smarter decision-making: Turn raw data into actionable strategies.

For example, prompts like this can turn your AI assistant into a budgeting coach:

“Analyze my past 3 months of expenses and suggest 3 ways I can save 10% next month.”

Or as an investment advisor:

“Based on my risk tolerance and monthly savings, recommend 3 ETF investment options and explain the pros and cons of each.”

🔧 Building a Prompt-Driven Personal Finance System

If you’re new to using AI for money management, start by designing a simple AI-driven financial workflow. Here’s how:

1. Budgeting Prompts

Use AI to automatically create or refine your budget:

- “Create a monthly budget for a freelancer earning $5,000/month with irregular income.”

- “Categorize my expenses into needs, wants, and savings using the 50/30/20 rule.”

2. Investing Prompts

Leverage AI to understand markets and make smart investment decisions:

- “Explain dollar-cost averaging like I’m new to investing and create a sample plan for me.”

- “Summarize today’s market trends from reliable sources and highlight key takeaways for long-term investors.”

3. Financial Planning Prompts

Plan your future like a pro—from emergency funds to retirement goals:

- “Help me calculate how much I need to save monthly to retire by age 60 with $1M.”

- “Build a step-by-step financial plan for paying off debt and investing simultaneously.”

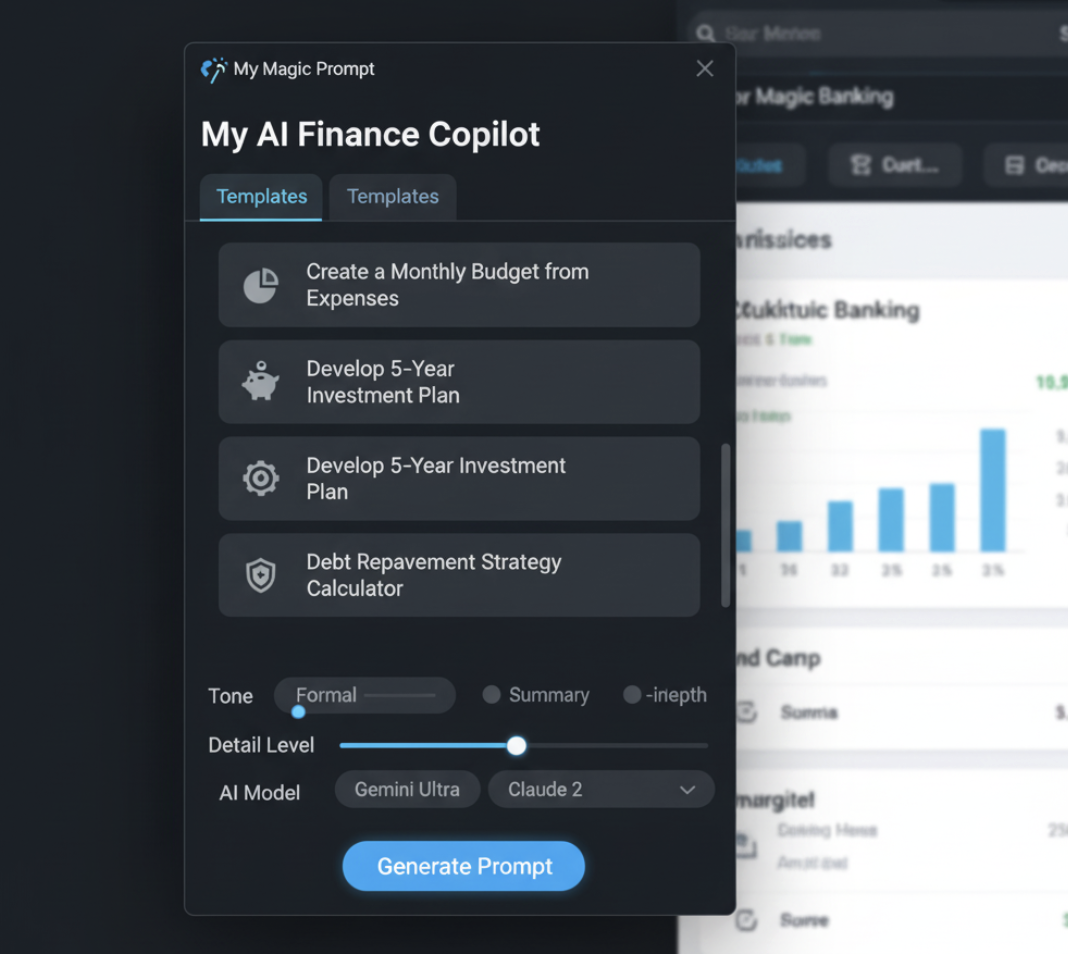

🕹️ How My Magic Prompt Makes Financial Prompting Effortless

While you can write your own financial prompts, most users struggle with phrasing them clearly. That’s where My Magic Prompt becomes your AI finance copilot.

With prompt templates and an intuitive prompt builder, you can:

- Access ready-made finance prompts for budgeting, debt management, and investing.

- Customize tone, detail level, and format for any AI model—from ChatGPT to Claude.

- Save your best-performing prompts to build a reusable AI finance toolkit.

For Chrome users, the Magic Prompt Chrome Extension integrates directly into your workflow, letting you create and refine finance prompts without switching tabs.

💼 Expert Insights: AI and Financial Literacy

According to Harvard Business Review, the rise of consumer-facing AI tools is improving financial literacy by making complex concepts more interactive and accessible. AI doesn’t replace human advisors—it amplifies them.

By using the right prompts, you can:

- Simulate different financial outcomes before committing.

- Ask your AI to explain terms like “compound interest” or “asset allocation” in plain English.

- Keep learning continuously as the AI tracks and refines your goals.

❓ Frequently Asked Questions About AI Personal Finance

1. Can AI really manage my finances accurately?

AI can analyze and summarize your data, but you should always double-check with trusted financial sources or advisors before making big decisions.

2. What are the best AI prompts for budgeting?

Start with prompts that help categorize expenses, identify savings opportunities, or set spending limits.

3. How do I make sure my financial data is secure?

Avoid sharing sensitive banking info directly in AI chats. Use anonymized summaries or mock data when possible.

4. Can AI help me invest?

AI can suggest strategies and summarize trends but should complement—not replace—human financial judgment.

5. How does My Magic Prompt help with AI personal finance?

It provides tested, high-performing prompts for all major AI tools, so you spend less time writing and more time taking action.

❤️ Ready to Take Control of Your Finances with AI?

AI won’t replace your money decisions—but it can make them smarter. Whether you’re budgeting for a side hustle or planning for retirement, your next great financial decision might start with a single, well-crafted prompt.

Explore My Magic Prompt to access expert-designed templates and prompt frameworks that simplify every aspect of your financial journey.